Most B2B manufacturers talk about “going digital” like it’s a single switch to flip.

It’s not.

You’re not selling one thing, you’re selling dozens of buying experiences.

→ Spare parts that should be as simple as Amazon.

→ Maintenance services that should be as easy as booking a haircut.

→ Heavy equipment buyers comparing specs for subzero conditions, and your website greets them with a product grid and a “Contact Us” button.

Digital sales isn’t one project. It’s a portfolio of different buying journeys, each with its own logic, tools and expectations.

The companies getting this right don’t ask “How do we sell online?”

They ask “Where do we start, and how do we scale from there?”

The Four Sales Motions (And Why Each One Is Different)

If you’re treating all of your digital sales the same way, you’re leaving money on the table. Here’s what each sales motion really needs and why it matters.

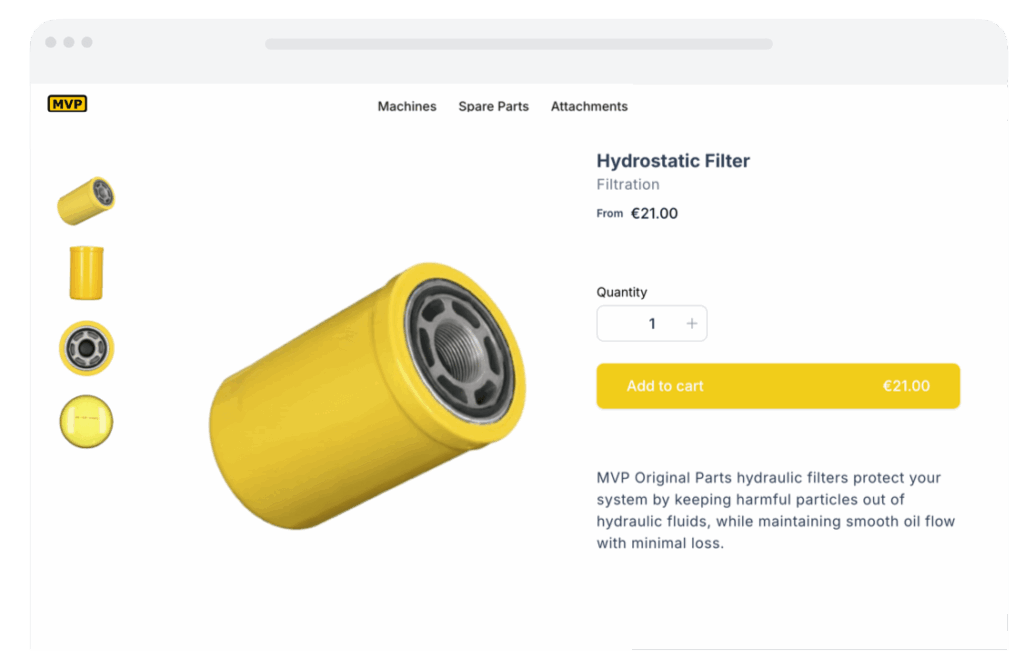

1. Simple Reorders & Spare Parts

Customers know exactly what they need. They just want to order it fast.

What it needs: A frictionless experience with clear pricing, minimal steps and 24/7 availability.

The trap: Treating it like a complex sale and forcing buyers to wait for quotes or talk to sales (of course, only during office hours)

Real example: Metsätyö, a Finnish supplier of wear steel and road maintenance equipment, serves customers who work night shifts. Their buyers needed to place orders at 2 AM, not wait until the office opened. By adding a B2B shopping cart to their website, Metsätyö gave customers instant ordering power. No calls, no waiting.

Why it works: When the buying decision is already made, speed wins.

2. Exploratory Buying & Long Sales Cycles

Prospects are early in their research. They’re comparing options, trying to understand what fits and aren’t ready for sales yet.

What it needs: Product discovery tools, transparent pricing and configurators that let buyers explore without pressure.

The trap: Forcing prospects into sales conversations too early. Hiding basic pricing information.

Real example: Naava sells intelligent green walls (living air purifiers). Their long sales cycles and wide buyer mix made early engagement tough. By adding a self-service configurator with transparent pricing, Naava captured prospects at the right moment, shortening sales cycles and improving lead quality.

Why it works: Buyers want to explore before they commit. Let them.

3. Complex Configuration & Visualization¨

For customizable products, the challenge isn’t just price, it’s clarity.

What it needs: Visual configurators showing real-time changes and pricing by market.

The trap: Relying on static PDFs that confuse buyers.

Real examples:

• SYIL sells €50k–€100k CNC machines across 30+ countries. With visual configurators in 10+ languages, they grew quote requests 25% with higher buyer intent.

• Best-Hall builds massive fabric structures. Their configurator lets prospects visualize every choice, generating €21.7M in qualified requests and €54.7M in leads.

Why it works: When buyers can see what they’re getting, and how options affect price, they move faster.

4. Distributor & Partner Sales

You sell through a network of distributors or dealers, each with their own pricing, regions and priorities.

What it needs: Multi-channel tools with localized pricing, language support, and shared lead generation.

The trap: Expecting distributors to handle digital transformation on their own.

Real example: SYIL sells exclusively through dealers. By running digital configurators that route qualified leads to each dealer, they empower partners instead of competing with them. Frans Buikema, SYIL’s Global Sales and Marketing Director, says: “Most dealers are traditional. We do it for them: killer websites, configurators, and qualified leads. That makes them prioritize selling our machines.”

Why it works: Distributors want warm, qualified leads, not cold prospects. When you deliver them, you win loyalty.

Why Most Companies Get This Wrong

The problem isn’t ambition, it’s oversimplification.

Too many companies treat digital sales like a checkbox project instead of a strategy.

They hide pricing because ‘every deal is unique’ and lose buyers who just wanted a reference point. They drown in contact forms from people who were just browsing.

That’s not digital transformation. That’s digital decoration.

The winners know better. They build one sales motion that fits their biggest pain, then scale from what works.

How to Start (Without Overcommitting)

You don’t need a five-year roadmap. You need one good experiment.

Step 1: Find the friction.

❏ Where are you losing the most time or money?

❏ Are buyers bouncing because they can’t see pricing?

❏ Are sales reps quoting manually all day?

❏ Are dealers stuck waiting for leads?

Step 2: Match the motion.

– If customers already know what they need → Launch storefront to enable easy buying.

– If they’re still comparing → Add a product finder and/or product configurator.

– If products are complex → Go with Visual CPQ

– If you sell through dealers → Build tools that make them shine: dealer portal with dealer specific products and pricing.

Step 3: Ship small, learn fast.

Build one motion.

Measure. Iterate. Expand.

CTN, a global seller of sport recovery machines, started with a simple quote configurator. It helped buyers explore and request quotes easily, generating €4.3M in pipeline in five months. They didn’t go all digital, they solved one friction point first.

The Bottom Line

There’s no such thing as ‘digital sales’ in B2B manufacturing.

There are spare parts orders, exploratory buyers, complex configurations and distributor networks, each needing its own playbook.

The companies still running on PDFs and hope will keep wondering why digital doesn’t work.

The ones who get it? They pick one motion, nail it, and build from there.

That’s not transformation, that’s evolution. And it’s already happening.

Want to see how manufacturers like SYIL or Metsätyö started? Explore their buying experiences built on HeadQ.